Getting paid late can be extremely frustrating for small business owners. Your client agrees to the payment terms, you deliver your part, and then — crickets. Even though late payors may eventually follow through, you deal with the stress, follow-up attempts, and missing cash flow in the meantime. But you don’t have to be a sitting duck. Here are 8 ways you can take action to prevent late payments.

1. Set clear payment terms upfront

When working with a client, communicate and gain agreement for the payment terms upfront. You can do so by drafting a contract that outlines the key aspects of the payment agreement, including:

- Amounts owed: The amount the client owes you for a defined deliverable.

- Payment due dates: The date the payment is due.

- Accepted payment methods: The different ways the client can pay you, such as check, credit card, debit card, or ACH.

- Consequences for unpaid amounts: What happens if the payment goes unpaid beyond a certain amount of days such as penalties, collection attempts, and taking them to court.

Review the terms with clients and get their signatures before you start any work. Being proactive can help to set a professional precedent, reduce misunderstandings, and hold both parties accountable. Your terms can also help to scare off unscrupulous clients from the get-go.

2. Invoice promptly and accurately

When you finish work and it’s time to invoice a client, don’t delay sending it over. For example, suppose you have an agreement where you invoice a client by the end of each month and the client pays you within 30 days of the invoice date. If you finish the work on the 15th and invoice immediately, you’ll get paid by the 15th of the following month. However, if you wait until the end of the month, your payment can come as late as the 30th of the following month. No need to let your money sit with clients longer than is necessary. Additionally, ensure everything on your invoices is accurate. If you make a mistake, your client may deny your invoice and require you to send a corrected version, which could restart the payment timeline.

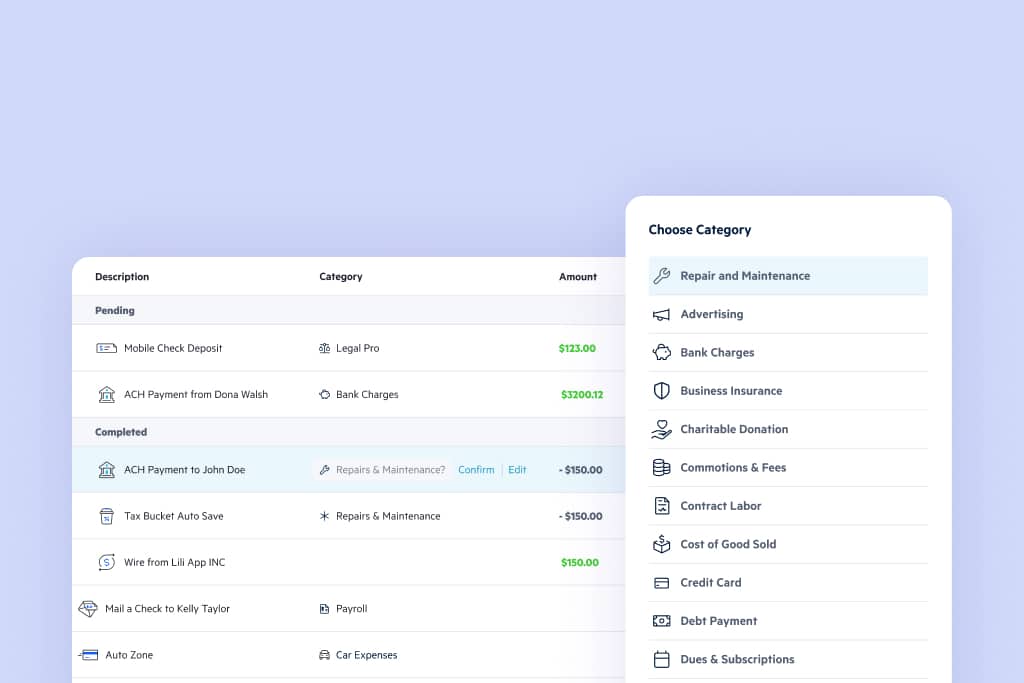

3. Offer multiple payment methods

By offering clients the ability to pay you through various payment methods, you improve your chances of getting paid sooner. For example, if you only accept ACH payments and checks but a customer doesn’t have the money in their checking account yet, they’ll need to delay the payment. However, with a service like Lili, which accepts Debit and Credit Cards (Visa, Mastercard, Amex), ACH, Venmo, Cash App, PayPal, checks, and cash, your client could pay immediately. A variety of options makes it easier to get paid promptly.

4. Provide early payment incentives and late payment penalties

You know the saying you can catch more flies with honey than vinegar? Well, that can also be true when it comes to getting paid on time. In addition to penalizing clients for paying late, you can also incentivize them to pay early by offering a small discount. For example, your payment terms could include:

- 5% off for paying within 7 days

- Invoice cost for paying from 8 to 30 days

- 5% penalty for paying 1 to 7 days late

- 10% penalty for paying 8 to 14 days late

- 15% fee for paying 15 to 30 days late

- Formal collection attempts begin at 30 days unpaid

- Court filings begin at 90 days unpaid

Clients who can pay early will likely want to take advantage of the savings which can help you stay cash flow positive. As for those who pay late, you’ll also get compensated for the inconvenience.

5. Send payment reminders

While clients may have the best intentions, most are juggling a laundry list of responsibilities so tasks can occasionally fall through the cracks. You can prevent your invoices from getting lost in the shuffle by setting up automatic payment reminders. For example, Lili’s invoicing software automatically sends reminders leading up to payment due dates so you don’t have to worry about it. Additionally, if your client doesn’t pay on time, you don’t have to craft those payment request emails. Lili will handle that part for you, too.

6. Set up milestones for larger projects

When working on large projects, the timelines can be long and the invoices can be large. Instead of carrying all the risk and waiting on one big payment at the end, consider breaking up the project into smaller milestones. For example, if you have a $20,000 job that’s going to take eight weeks, you could break it down into smaller parts with payments of $5,000 due every two weeks. This approach prevents you from getting heavily invested without pay and will reveal clients who don’t pay on time much earlier.

7. Build strong client relationships

Some people don’t manage their money or business in a way that allows them to make payments on time. It’s not personal, it’s just how they operate. However, those aren’t the clients you typically want to keep around long-term. Strong, healthy businesses are built on mutually respectful and beneficial relationships. You want clients who value your work and pay you promptly as a sign of respect for you and your business. When you find them, prioritize them and their work. In time, your entire business can be built on those kinds of relationships and late payments can become a thing of the past.

8. Request deposits

Requiring deposits can be a great way to improve your cash flow and weed out problem clients. Doing so can be especially helpful when a client has paid late in the past, given you reason to doubt they will pay, or is requesting a project that will require an upfront investment from you. Additionally, if you want to split the risk evenly with a client, you can do so by requesting half of the payment upfront and half when the project is done.

Simplify cash flow management with Lili

Cash flow can make or break a small business, but gaining control over it can be as simple as making a few tweaks to your contract. Lili’s all-in-one financial platform for small business owners makes it easy to implement these changes. From robust invoicing that accepts multiple payment methods to advanced bill pay, and financial insights that optimize cash flow, Lili helps streamline operations. By giving you control over payment processing, reminders, and more, Lili allows you to maintain a healthy cash flow, ensuring your business stays on track for growth and success.

Learn more about Lili and how it can benefit your business’s cash flow.

Accounting, tax preparation and invoicing software is available to Lili Smart and Lili Premium account holders only; applicable monthly account fees apply. For details, please refer to the Sunrise Banks Account Agreement. Lili is a financial technology company, not a bank. Banking services are provided by Sunrise Banks, N.A., Member FDIC.